More than 45 million Americans collectively owe over $1.7 trillion in student debt.

Economists say this mounting total worsens generational inequality, slows economic growth and exacerbates racial disparities. On a micro-economic level, borrowers also face serious consequences in their day-to-day lives.

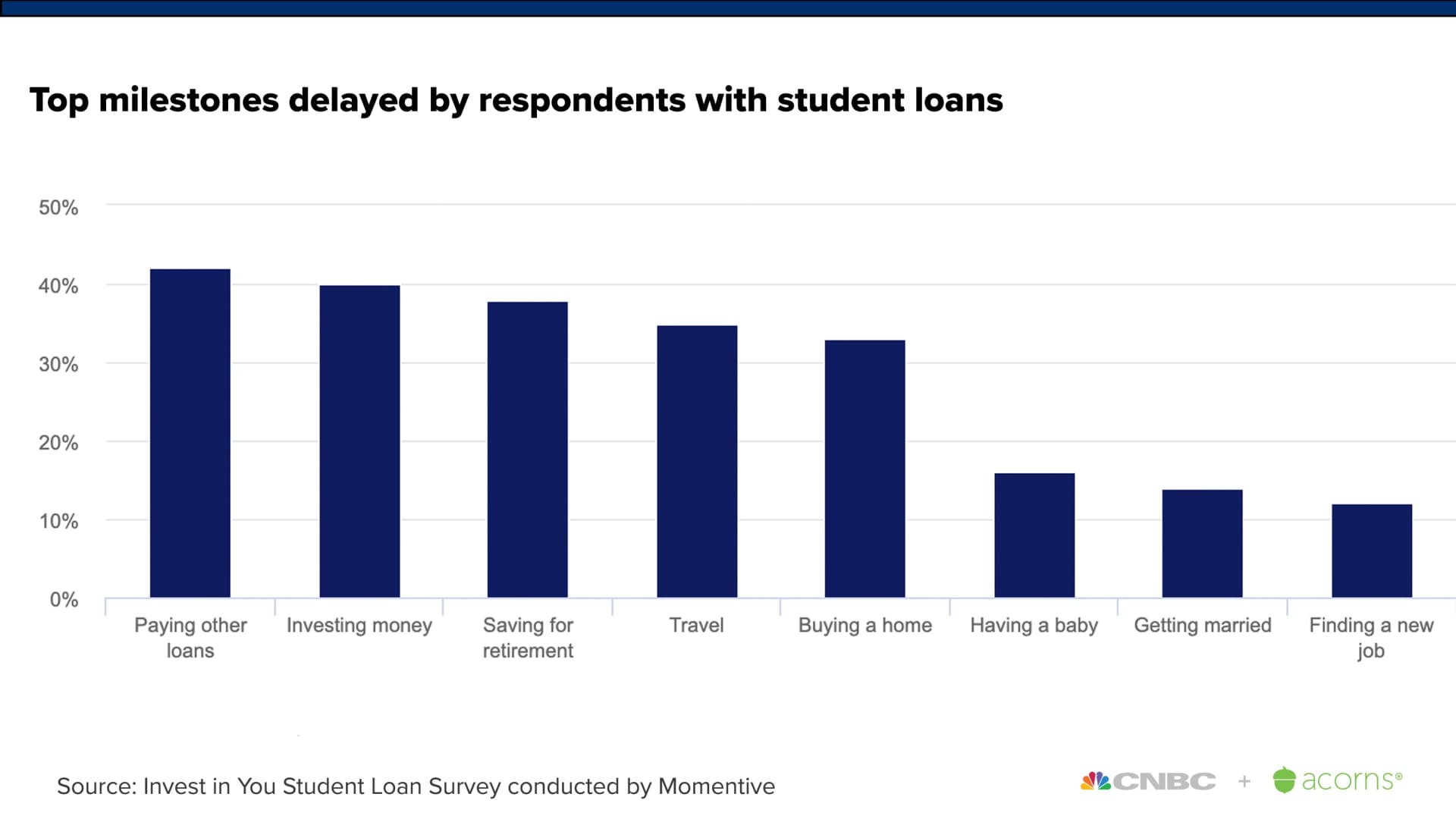

According to CNBC + Acorn's recently released Invest in You Student Loan Survey conducted by Momentive, 81% of people with student loans say they've had to delay one or more key life milestones because of their debt. Momentive surveyed 5,162 American adults between Jan 10 and Jan 13 online to better understand the impact of student debt.

The survey found that among student loan borrowers, 42% delay paying off other loans, 40% delay investing money, 38% delay saving for retirement, 35% delay travel, 33% delay buying a home, 16% delay having a baby, 14% delay getting married and 12% delay finding a new job.

Get top local stories in Southern California delivered to you every morning. >Sign up for NBC LA's News Headlines newsletter.

"Student loan debt prevents family formation, it prevents people from making decisions about their life, about purchasing a home, about buying their first car, about getting married, about having children," lists Nicole Smith, chief economist at the Georgetown University Center on Education and the Workforce. "And that wasn't the purpose of student loan debt. Student loan debt was supposed to be good debt — the type that you take out so that you can invest in your human capital formation so that you can live your life afterward — and it's morphed into something much more insidious."

Momentive researchers found that the most common sacrifices made by borrowers varied slightly by age. For instance, those aged 35-64 were most likely to delay paying off other loans, while borrowers under 35 were most likely to delay buying a home or investing.

Money Report

More from Invest in You:

Majority of borrowers say taking on federal student loan debt is not worth it, survey finds

Most Americans want Biden to prioritize student loan forgiveness, survey says

Student loan holders are more likely to be women and people of color

"The weight of student loans is a cloud that weighs over every financial decision, from your daily coffee to your big life decisions," says Braxton Brewington, press secretary for The Debt Collective, a union organization that represents student debt holders. "So many people say they would start a business if they did not have student debt. So many people delay getting married because they don't want their partner to take on the debt."

Brewington says he has even spoken with borrowers who have rationed medication because of their student loan burden.

This dynamic in which student loan borrowers can't save for the future, or for emergencies, makes for a less stable society, says Smith.

Paying off student debt "first affects your ability to get the standard things that are often required to transition into adulthood: a house, a car and a family," she says. "That's what happens immediately. But on the back end of that… you often end up living on a razor's edge. Because if there's any eventuality, anything that happens outside of your equilibrium, you run the risk of bankruptcy."

And for many people hoping to compete in the modern economy, attending college and taking on student loan debt can feel unavoidable.

"On the one hand, here's student debt, it's a burden around your neck, it's this anchor that's weighing you down for the next X amount of years," says Smith. "And we also know that for the past 40 years or so, at least since the advent of the personalized computer, education has been the arbiter of economic mobility and economic freedom."

She continues, "and so you're often essentially walking a tightrope between recognizing what needs to be done and understanding that there may be horrible consequences."

LISTEN NOW: Should student loan debt be forgiven? What are the hidden costs of college? Should financial education start at an earlier age? CNBC reporters and contributors discussed these topics and more on Twitter spaces.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.