- This $1.35 billion jackpot marks Mega Millions' second-largest grand prize ever and the fourth-largest in lottery history.

- The odds of a hitting the grand prize are 1 in 302.6 million.

- If you win, be aware that there's "an emotional component to this type of newfound wealth that is almost as large as the winnings," said one expert.

There's a chance a Mega Millions player is on the verge of joining a very short list: winners who snag a jackpot worth more than $1 billion.

The grand prize is an estimated $1.35 billion for Friday night's drawing. That's how much you'd win if you were to take the windfall as an annuity paid out over three decades. (The upfront cash option is $724.6 million as of mid-day Friday).

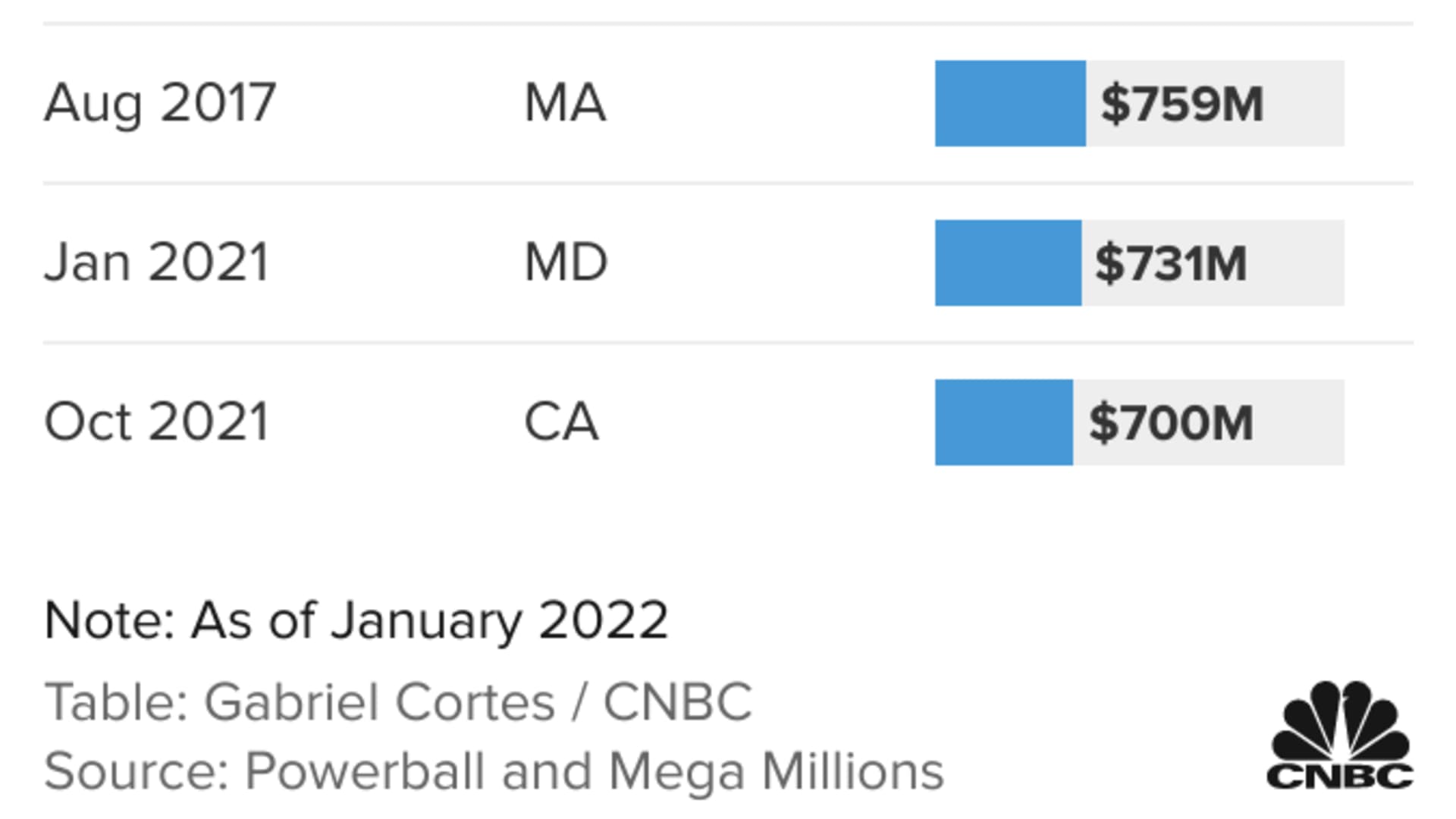

Between Mega Millions and Powerball, there have been winners of five other jackpots totaling more than $1 billion, including one worth more than $2 billion. If Friday's drawing produces a winner (or winners), the amount would mark Mega Millions' second-largest jackpot ever and the fourth-largest lottery prize in history.

Get top local stories in Southern California delivered to you every morning. >Sign up for NBC LA's News Headlines newsletter.

With only a tiny chance of a single number combination hitting the motherlode — 1 in 302.6 million — the amount has been growing through twice-weekly drawings since Oct. 14. That's when the jackpot was reset to $20 million after two tickets sold in Florida and California split a $502 million grand prize.

If you happen to beat the odds stacked against you, be aware that winning won't be as simple as claiming your prize and carrying on with life, experts say.

Money Report

"There is an emotional component to this type of newfound wealth that is almost as large as the winnings," said Emily Irwin, managing director of advice and planning at Wells Fargo Wealth & Investment Management.

"Part of that is you most likely would go through cycles of surprise, shock, relief and then probably a sense of 'what do I do next?'" Irwin said. "It can be incredibly overwhelming."

Here are some tips to help guide you in the initial phase of being a jackpot winner.

1. Avoid sharing the news

Experts generally recommend keeping your news quiet. That means sharing it with, say, only immediate family or a trusted friend.

"You should try not to tell anyone, which is really hard," said David Lehn, a partner at Withers who serves on the law firm's private client and tax team.

More from Personal Finance:

You can still get 2023 health insurance through public exchange

Tax season opens for individual filers on Jan. 23, says IRS

Here’s the inflation breakdown for December 2022 — in one chart

The problem is that news has a way of traveling, and you may end up fielding requests from family and friends, and even strangers, who hope to get a sliver of your winnings.

2. Protect your ticket

Be sure you have somewhere safe to store your ticket, such as a lockbox. Experts also suggest snapping a photo of yourself with the ticket.

Additionally, while it's often recommended that you sign the back of the ticket right away, it may be worth knowing your state laws first.

Some jurisdictions let you remain anonymous. Others do not — but in those states, you might be able to create a legal entity such as a trust that claims the windfall and shields your name from the public. In other words, the trust's name would need to be what's on the back of the ticket.

3. Don't be in a rush

There's no need to rush to lottery headquarters. Depending on where you bought the ticket, you get anywhere from 60 or 90 days to a year to claim your windfall. Be aware that in some states, there may be a shorter window to claim if you want the cash instead of the annuity.

This pre-claiming time is when you should assemble a team of experts. That group should include at least an experienced attorney, a tax advisor and financial advisor.

This group can help guide you in your decision-making as you navigate your new-found wealth.

For example, one of the first decisions you'd make is whether to take the $1.35 billion as an annuity or as a one-time lump sum payment of $724.6 million.

Either way, there would be taxes withheld and more likely owed. You also would need to consider how and when to share your windfall.

However, you don't need to begin handling those big money matters right off the bat.

"As you begin working with your team … your goals and values are an incredible place to begin the conversation," Irwin said. "You don't want to get so caught up in the taxes and [other financial aspects] before you think about what's really important, because that will inform all your other decisions."

Meanwhile, Powerball's jackpot is $404 million (with $211.7 million cash option) for its next drawing, set for Saturday night. The chance of hitting the grand prize in that game is about 1 in 292 million.