- Shohei Ohtani made history this week with a 10-year, $700 million contract to play for the Los Angeles Dodgers.

- The Japanese superstar will only receive $2 million per year over the agreement and will defer $680 million.

- Some of the risks of deferred compensation include higher federal taxes, inflation and company solvency, experts say.

Shohei Ohtani made history this week with a 10-year, $700 million contract to play for Major League Baseball's Los Angeles Dodgers. The deal's unique payout structure, however, could carry some risks, financial experts say.

The Japanese superstar will receive $2 million per year over the 10-year agreement, which defers $68 million annually.

Ohtani isn't the first MLB player to defer income. Players such as Bobby Bonilla and Ken Griffey Jr. also chose yearly payments. In Bonilla's case, those came with a guaranteed 8% interest rate. But Ohtani will receive the bulk of his contract, $680 million in payments, between 2034 and 2043, without interest.

Get top local stories in Southern California delivered to you every morning. >Sign up for NBC LA's News Headlines newsletter.

More from Personal Finance:

Here's where deflation was in November 2023 — in one chart

What the restart of student loan payments means for your taxes

Here are 3 money tips every high school student should know

The deal could provide tax benefits for Ohtani if he leaves California before receiving his deferred income, according to certified financial planner Eric Bronnenkant, head of tax at Betterment.

For 2024, California's top tax rate climbs to 14.4%, which includes a 1.1% payroll tax on all income. Bronnenkant said federal law protects nonresidents from taxes on "retirement income," including payments structured for at least 10 years.

Money Report

But California might disagree, he added.

Ohtani could face higher federal tax rates on the deferred payments, said CFP and enrolled agent Louis Barajas, who is also CEO of International Private Wealth Advisors in Irvine, California. He is a member of CNBC's Financial Advisor Council.

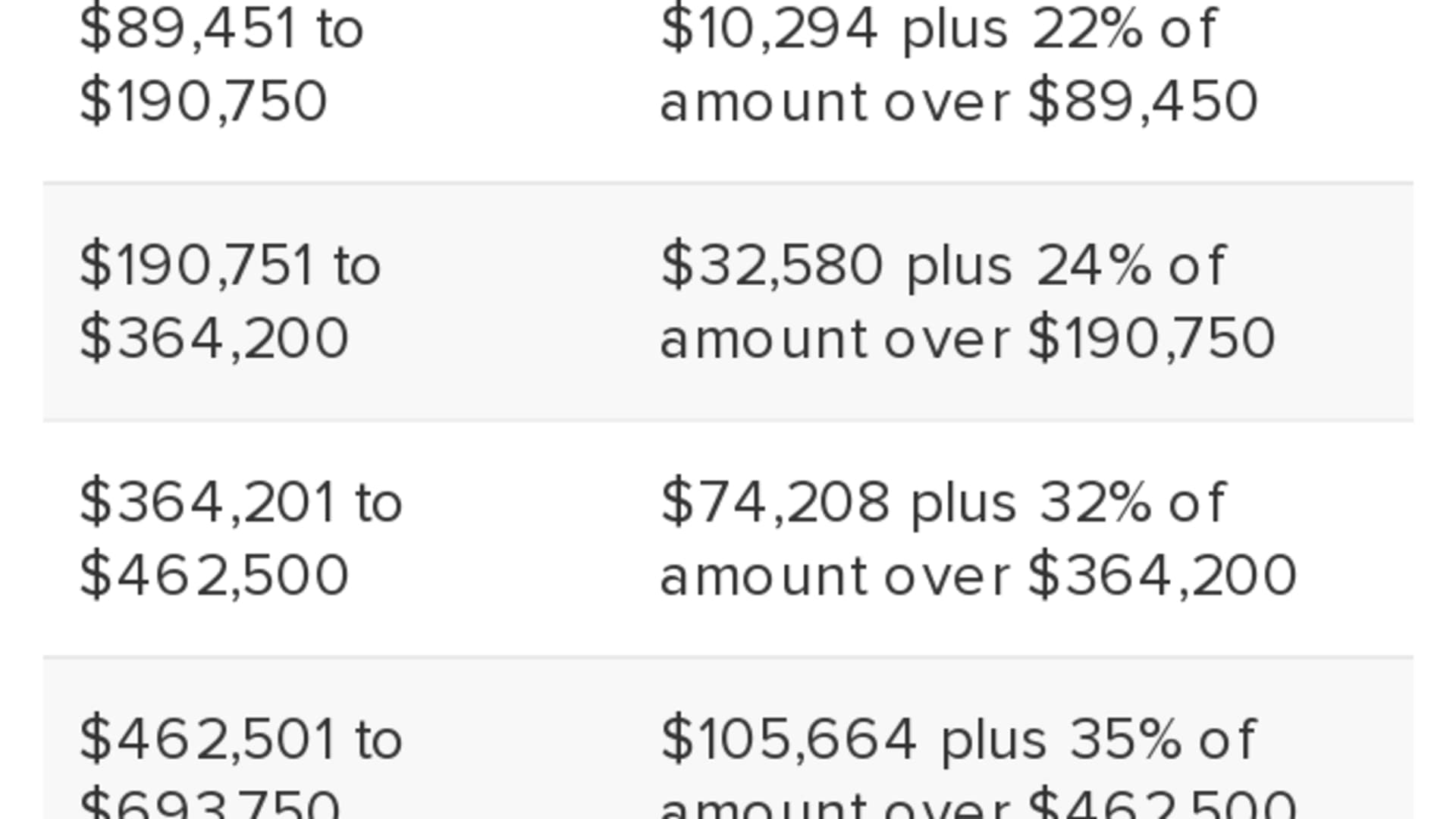

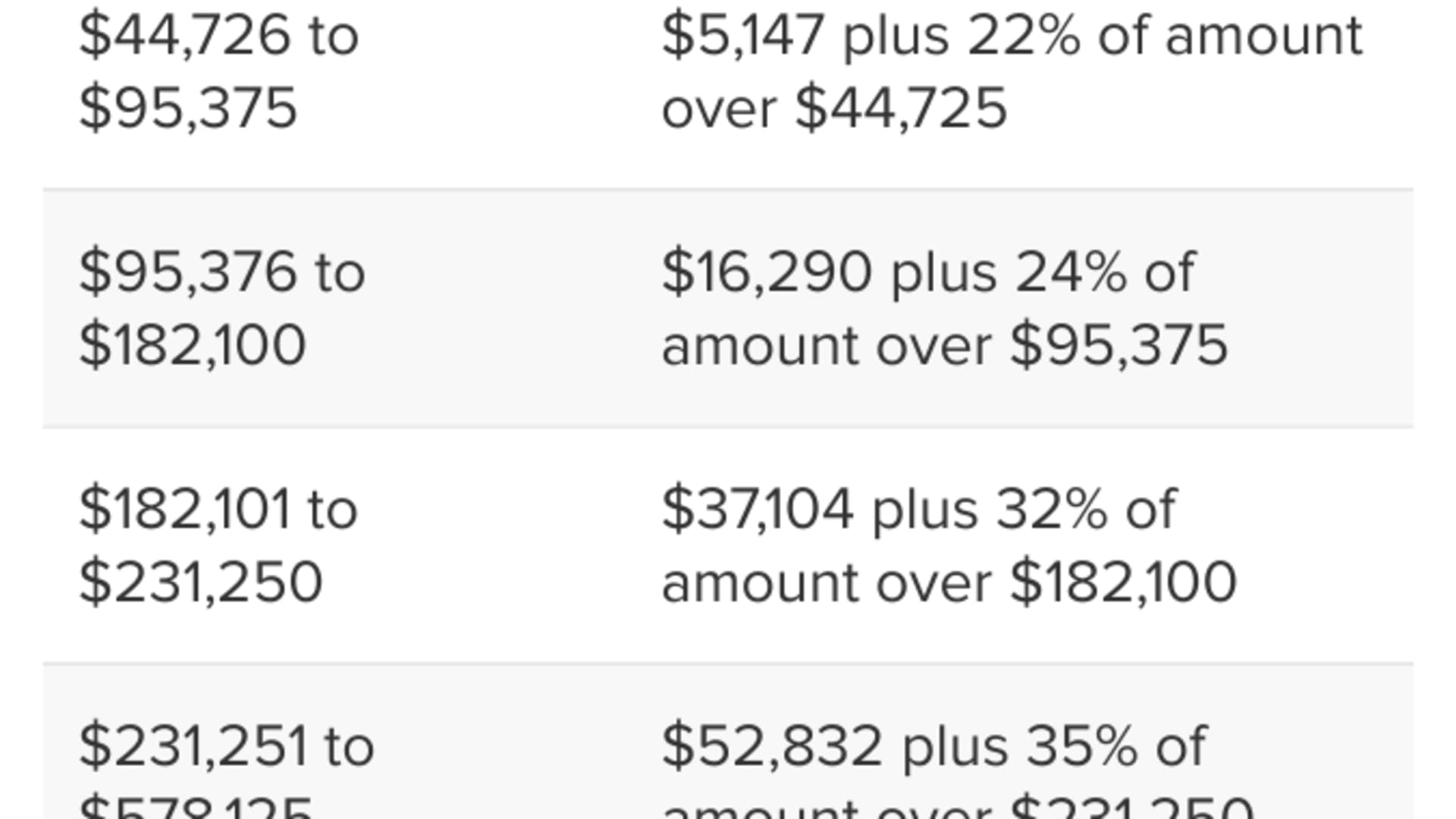

Without changes from Congress, the highest federal income tax rate will revert to 39.6% in 2026 from the current top rate of 37%. By accepting payments later, "he's taking a risk," Barajas said.

The opportunity costs of deferred income

Another downside of deferring income is Ohtani cannot spend or invest $68 million per year over the next decade.

"A dollar today is worth more than a dollar tomorrow," Barajas said.

By deferring payments without interest, Ohtani also faces reduced purchasing power. While inflation has dropped significantly since June 2022, it's difficult to predict rates over the next decade.

But if higher inflation returns, "the net value of his contract isn't worth as much as he thought," Barajas said.

The top risk of deferred compensation

While higher taxes and inflation could be issues for deferred income, the No. 1 concern is the company's ability to pay, experts say.

That's important for Ohtani's potential tax benefits. To delay taxes on $680 million of deferred compensation, his future income must be "at risk," per IRS guidelines, Bronnenkant said.

However, since he's working for the Los Angeles Dodgers, "the odds of that happening are slim to none," Barajas said.

Don't miss these stories from CNBC PRO: