Stocks mounted a dramatic comeback on Monday as investors stepped in to buy beaten-up tech shares following a sharp sell-off earlier in the day.

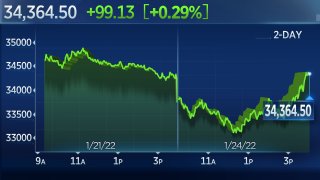

The Dow Jones Industrial Average closed up 99.13 points, or 0.3%, at 34,364.50, gaining for the first day in seven. The S&P 500 finished higher by 0.3% at 4,410.13. The Nasdaq Composite gained 0.6% at 13,855.13. The Russell 2000 index of small-cap shares closed up as well.

The Nasdaq Composite Index turned positive after being down as much as 4.9% earlier in the session. The Dow rallied after being down 1,115 points at one point. The S&P 500 closed in the green after briefly hitting a correction earlier in the session, falling more than 10% from its Jan. 3 record close.

Get top local stories in Southern California delivered to you every morning. Sign up for NBC LA's News Headlines newsletter.

Monday marked one of the best market comebacks in a long time. The session was the first time since the aftermath of the financial crisis in 2008 that the Nasdaq Composite had been down more than 4% on the session and closed up. For the Dow, which was down 3.25% at its low, it was the biggest intraday comeback since the wild trading of March 2020.

JPMorgan's top stock strategist Marko Kolanovic said in a note Monday that the sell-off in equity markets was overblown.

"The recent pullback in risk assets appears overdone, and a combination of technical indicators approaching oversold territory and sentiment turning bearish suggest we could be in the final stages of this correction," Kolanovic said. "While the market struggles to digest the rotation forced on it by rising rates, we expect the earnings season to reassure, and in a worst case scenario could see a return of the 'Fed put.'"

Money Report

Investors began Monday's session dumping technology shares, as they have all month, on fears the Federal Reserve would soon aggressively tighten policy. However, those shares rebounded as the day went on with Facebook-parent Meta, Amazon and Microsoft closing higher.

Despite Monday's rebound, the S&P 500 is still down 7.5% this month, on pace for its worst monthly performance since March 2020. The rout this year initially centered around the Nasdaq and technology stocks with investors rotating out of shares whose valuations look less attractive as rates rise. The market action Monday followed a brutal week on Wall Street in the face of mixed company earnings.

Selling may have reached a capitulation point with the CBOE Volatility Index (VIX), known on Wall Street as the market's "fear gauge," hitting its highest level since November 2020, surpassing the 38 level at its intraday highs.

Once the fear gauge hits those extremes, the market has a tendency to snap back, even if only temporarily.

Investors are eyeing the Fed's policy meeting, which begins on Tuesday and wraps up Wednesday. Market participants will be looking for any signals on how much the central bank will raise interest rates this year and when it will start.

"The greatest fear is how the Fed reacts and keeps this balancing act," Ann Miletti, head of active equity at Allspring Global Investments, told CNBC's "Squawk on the Street" on Monday. "There's going to be a lot of turbulence as we march through these next couple of months."

The Federal Open Market Committee, which sets interest rates, is meeting with expectations that it will not act at the January meeting, but will tee up the first of multiple rate hikes starting in March. In addition, the Fed is expected to wrap up its monthly asset purchase program that same month.

At his post-meeting news conference, Chairman Jerome Powell also could signal when the Fed will start to unwind its mammoth balance sheet.

Goldman Sachs said over the weekend that it sees risks rising that the Fed could enact even more than the four quarter-percentage-point hikes that the market has priced in for this year. The firm also said the Fed might start running off the nearly $9 trillion in assets it is holding in July.

Investors also monitored geopolitical tensions as Russia built up its military presence at the Ukrainian border. President Joe Biden is set to speak with European leaders Monday amid fears of a possible Russian invasion of Ukraine.