- The wealthy are building "passport portfolios" — collections of second, and even third or fourth, citizenships — in case they need to flee their home country.

- Recent high-profile examples of second citizenships include billionaire tech investor Peter Thiel, who added a citizenship in New Zealand, and former Google CEO Eric Schmidt, who applied for citizenship in Cyprus.

- The top destinations for supplemental passports among Americans are Portugal, Malta, Greece and Italy, according to Henley & Partners.

A version of this article first appeared in CNBC's Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

Wealthy U.S. families are increasingly applying for second citizenships and national residences as a way to hedge their financial risk, according to a leading law firm.

Get top local stories in Southern California delivered to you every morning. Sign up for NBC LA's News Headlines newsletter.

The wealthy are building these "passport portfolios" — collections of second, and even third or fourth, citizenships — in case they need to flee their home country. Henley & Partners, a law firm that specializes in high-net-worth citizenships, said Americans now outnumber every other nationality when it comes to securing alternative residences or added citizenships.

"The U.S. is still a great country, it's still an amazing passport," said Dominic Volek, group head of private clients at Henley & Partners. "But if I'm wealthy, I would like to hedge against levels of volatility and uncertainty. The idea of diversification is well understood by wealthy individuals around what they invest. It makes no sense to have one country of citizenship and residence when I have the ability to actually diversify that aspect of my life as well."

Recent high-profile examples of second citizenships include billionaire tech investor Peter Thiel, who added a citizenship in New Zealand, and former Google CEO Eric Schmidt, who applied for citizenship in Cyprus.

Money Report

Of course, the wealthy aren't packing up en masse and ditching their American citizenship. While a relatively small number of Americans do renounce their citizenship every year to declare a new home country, mainly due to tax-filing requirements, the so-called "exit tax" required to renounce citizenship makes it financially prohibitive for most except the ultra-wealthy to simply renounce and declare a new citizenship.

Instead, many wealthy Americans are shopping around for an added visa or citizenship program to supplement their U.S. passport.

According to Henley, the top destinations for supplemental passports among Americans are Portugal, Malta, Greece and Italy. Portugal's "Golden Visa" program is especially popular since it provides a path to residency and citizenship — with visa-free travel in Europe — in exchange for an investment of 500,000 euros (roughly $541,000) in a fund or private equity. Malta offers a Golden Visa for 300,000 euros invested in real estate, which Volek said has become "especially popular with Americans."

"With Malta you become a European citizen, with complete settlement rights across Europe," he said. "So you can live in Germany, your kids can go and study in France and you have the right to live, work and study throughout Europe."

There are three main reasons for the rise of American passport portfolios, or "domicile diversification." An alternative passport makes travel easier for Americans venturing to parts of the world that are less friendly to the U.S.

"For American, British, and Israeli citizens suddenly unsure of their welcome abroad, supplementary passports provide vital flexibility," according to a Henley report. "With rising global instability, holding citizenship in another country, particularly one that is considered more neutral or politically benign, now provides a valuable back-up or alternative option."

Another reason is business travel, which can be safer and less conspicuous with a non-U.S. passport in many countries. U.S. business leaders could be targets for "resentment, hostage-taking, or random terrorism in the chaos of collapsed states or high-risk countries they need to travel to for business purposes," according to the report, which says interested parties range from hedge-fund managers who meet with global clients to mining company executives who visit operations sites.

Using a secondary passport can also help cross-border financial transfers or deals within the new country.

Finally, some wealthy Americans simply want a back-up residency for possible retirement, to be closer to their families who live abroad or for lifestyle reasons in the new age of remote work. For others, U.S. politics is the driver.

"We all live in uncertain times, not just in the U.S., but in all nations globally," Volek said. "Who knows what's going to happen next. It's really about having not only a Plan B but Plan C and D in place as well."

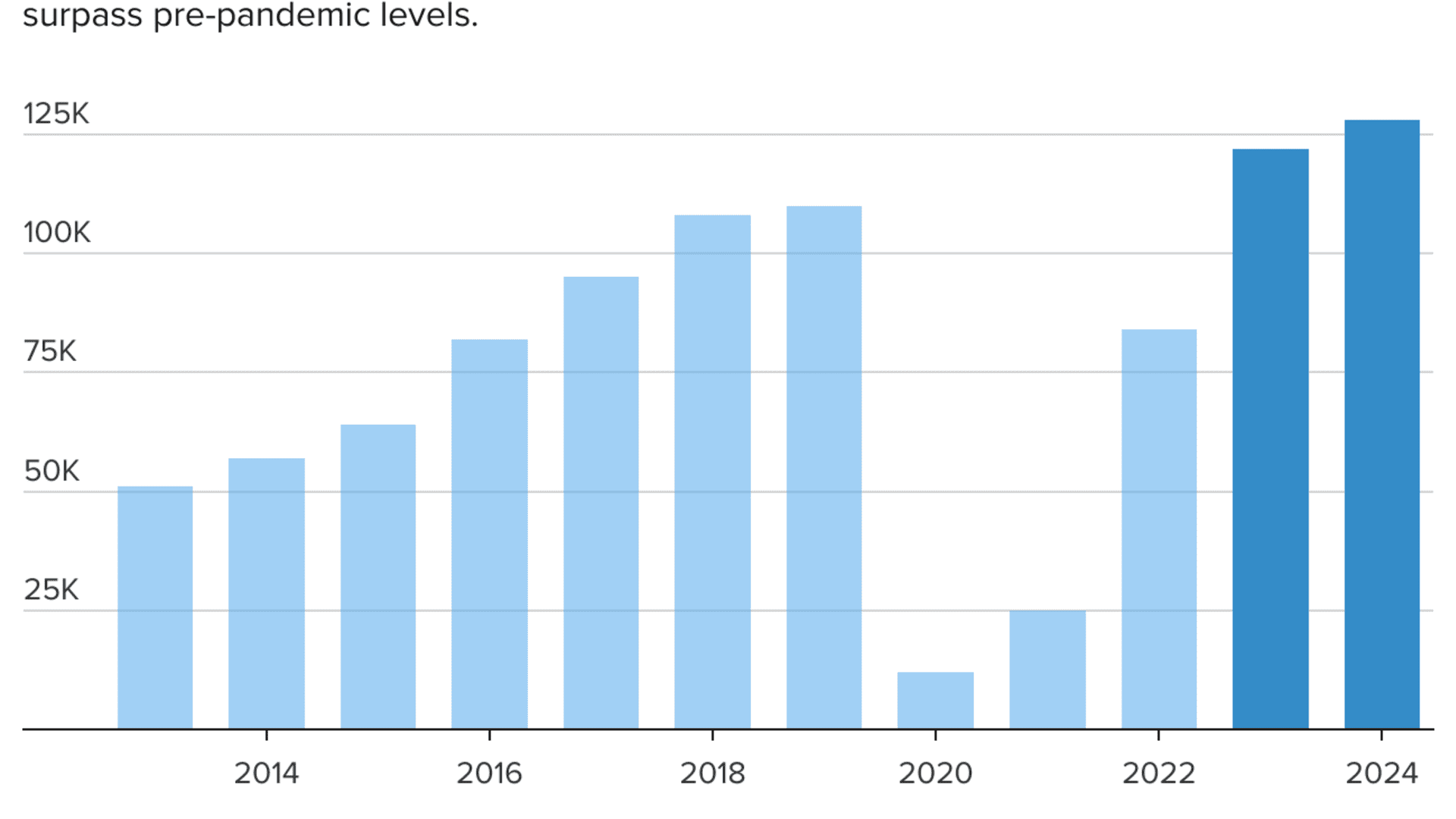

Globally, millionaire migration is expected to hit a new high in 2024, as wars, government crackdowns on wealth, and political uncertainty drive more wealthy residents to other countries. An estimated 128,000 millionaires are forecast to move to a new country this year, up from 120,000 in 2023 and up from 51,000 in 2013, according to Henley.

The U.S. remains a top destination for global millionaires leaving other countries, with a net inflow of 2,200 millionaires in 2023 and a projected inflow of 3,500 in 2024, according to Henley.

China remains the biggest source of millionaire out-migration, losing a net 13,500 millionaires last year.

"The wealth-creation opportunities in the U.S. are second to none globally," Volek said.

Sign up to receive future editions of CNBC's Inside Wealth newsletter with Robert Frank.