Traders work on the floor of the New York Stock Exchange (NYSE) on March 05, 2025, in New York City. F

U.S. Treasury yields were higher on Monday on reports President Donald Trump was backing off an all-out trade war, raising hope the U.S. economy could keep its expansion going.

The benchmark 10-year Treasury note yield rose more than eight basis points to 4.338%, and the 2-year Treasury yield was also more than nine basis points higher at 4.041%.

One basis point is equal to 0.01%. Yields and prices move in opposite directions.

The Wall Street Journal and Bloomberg News reported that planned tariffs from April 2 by the White House were set to be more narrow in scope and will likely exclude some industry-specific duties, providing optimism for investors. Trump had also hinted at "flexibility" for his reciprocal tariff plans on trading partners in comments made Friday.

Get top local stories in Southern California delivered to you every morning. Sign up for NBC LA's News Headlines newsletter.

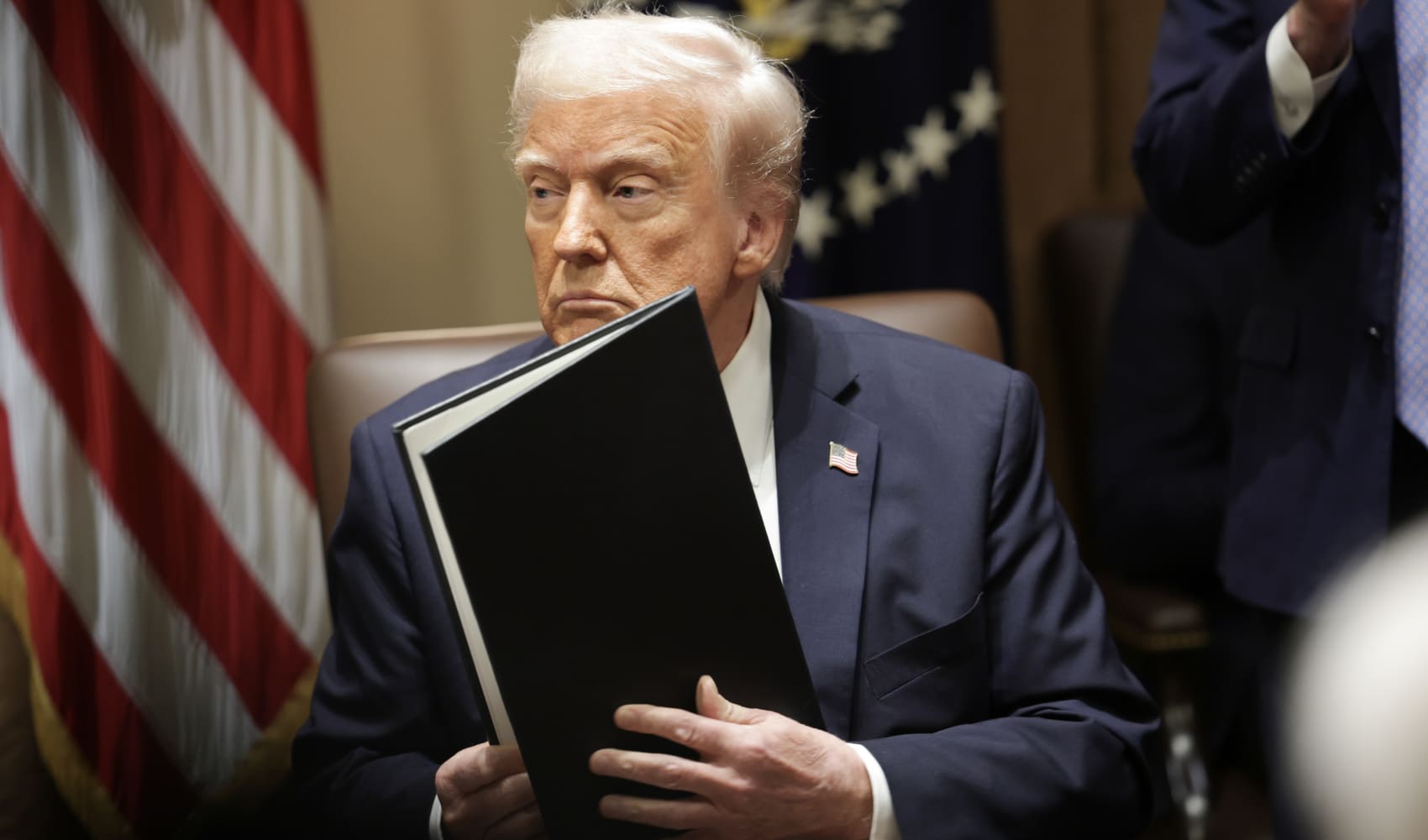

"People are coming to me and talking about tariffs, and a lot of people are asking me if they could have exceptions," Trump told reporters in the Oval Office. "And once you do that for one, you have to do that for all."

"I don't change. But the word flexibility is an important word … sometimes it's flexibility," he added. "So, there'll be flexibility, but basically, it's reciprocal."

Investors are also expecting a flurry of economic data this week.

Money Report

The PMI released on Monday turned in a reading of 54.3, higher than 51 in February and exceeding the 51.5 Dow Jones consensus estimate. A reading above 50 indicates expansion while a reading below 50 points to a contraction.

New home sales data will be out Tuesday, and weekly initial jobless claims on Thursday. The big data release of the week will be the personal consumption expenditures index — the Fed's preferred inflation gauge — on Friday.