California Gov. Gavin Newsom and legislative leaders announced a spending deal earlier this year aimed at aiding some of those hit hardest by the pandemic. The plan includes $600 to $1,200 stimulus checks — money that some Californians can expect to see soon.

Initially, the plan was to help low-income families. In May, Newsom announced that the plan will be expanded to middle-income families. That means the Golden State Stimulus now provides at least $600 to two-thirds of Californians.

The proposed expansion of the plan, part of the broader California Comeback Plan, needs to be approved by the state Legislature.

Here’s what to know about the Golden State Stimulus checks.

Get top local stories in Southern California delivered to you every morning. Sign up for NBC LA's News Headlines newsletter.

Who gets a check?

Individuals and households making between $30,000 and $75,000 a year would get a $600 payment. All households making up to $75,000 with at least one child, including immigrants in the country illegally who file taxes, would get an extra $500 payment.

It’s the second round of cash payments given by the state in response to the pandemic. Earlier this year, people making less than $30,000 got a $600 payment. Immigrants making up to $75,000 who file taxes, including those also living in the country illegally, also got the check. State officials chose a higher eligibility limit for those individuals because they didn’t get federal stimulus checks.

Local

Get Los Angeles's latest local news on crime, entertainment, weather, schools, COVID, cost of living and more. Here's your go-to source for today's LA news.

All combined, the state would spend $11.9 billion on direct cash payments.

Do I qualify?

If you’ve meet the following criteria, you qualify.

- You filed your 2020 taxes.

- You’re either a CalEITC recipient or an ITIN filer who made $75,000 or less (total CA AGI).

- You’ve lived in California for more than half of the 2020 tax year.

- You’re a California resident on the date the payment is issued.

- You’re not be eligible to be claimed as a dependent.

Click here for a complete list of qualifications.

When can I expect to see the money?

It depends on when your 2020 tax returned was filed and processed.

If you filed your tax return between Jan. 1 and March 1: You will receive your stimulus payment beginning after April 15.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you filed your tax return between March 2 and April 23: You will receive your stimulus payment beginning after May 1.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you file your tax return after April 23:

- Direct deposits: Allow up to 45 days after your return has processed

- Paper checks: Allow up to 60 days after your return has processed

- Note: Some payments may need extra time to process.

How much money will I get?

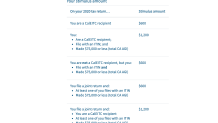

You can use the chart below to determine whether you'll receive a $600 or $1,200 payment.