-

How a homeowners insurance provision can help with living expenses after a natural disaster

“Loss of use coverage” can help homeowners and renters cover certain living expenses if their home was damaged in a natural disaster. Here’s what to know.

-

Consumer group slams Ricardo Lara's California homeowners plan

California’s Insurance Commissioner Ricardo Lara and his new set of regulations are to blame for higher insurance rates, Consumer Watchdog says. Gordon Tokumatsu reports for the NBC4 News at 3 p.m. on Tuesday, Sep. 17, 2024.

-

Why Southern California drivers are paying even more for car insurance

Motorists in the Los Angeles area are paying over 25% more for their insurance, compared to last year. Tracey Leong reports for the NBC4 News at 4 p.m. on Tuesday, July 9, 2024.

-

Why some Californians are forced to live without home insurance

With a spike in insurance rates, some California homeowners, who cannot afford their policy, may be opting to live without home insurance. Tracey Leong reports for the NBC4 News at 4 p.m. on Monday, July 8, 2024.

-

State Farm looking to raise insurance rates in California again. See how it may affect your policy

State Farm is seeking permission from the state to increase insurance rates as much as 50% for California policy holders.

-

California earthquakes: What to do before, during and after

No matter where you live in California, there is a risk of considerable damage due to an earthquake. Here is what you need to know before during and after the rumbling.

-

Biden announces new rule to protect consumers who purchase short-term health insurance plans

President Joe Biden is announcing new steps to protect consumers who buy short-term health insurance plans that critics say amount to junk.

-

State Farm cuts 72,000 home insurance policies in CA

Insurance options in California continue to dwindle as State Farm discontinues coverage for thousands of homes due to the company’s financial health, driving homeowners to apply for the California Fair Plan and consumer advocates to call for change. Ted Chen reports for the NBC4 News on March 22, 2024.

-

Sherman Oaks businesses struggle to find coverage as more insurance companies drop California

After a Sherman Oaks restaurant was left shaken by arsonists who lit a nearby dumpster ablaze, its owner is also left scrambling since its insurance carrier dropped their policy — and it’s not the eatery in its area to experience this.

-

Small businesses in Sherman Oaks plagued with crime lose insurance

Small businesses like Pineapple Hill Saloon & Grill and Casa Vega in Sherman Oaks are being dropped by insurance carriers due to recent crimes resulting in property damage. Bailey Miller reports for the NBC4 News on March 20, 2024.

-

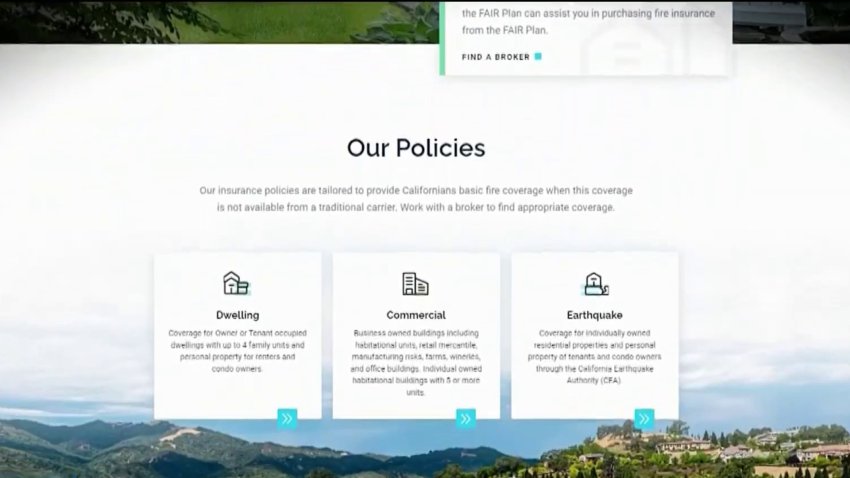

Homeowners struggle to secure California Fair Plan coverage

Homeowners are struggling to secure back coverage from the California Fair Plan. Carolyn Johnson reports for the NBC4 News I-Team on Feb. 8, 2024.

-

How to file a claim for damage to home or car amid historic Southern California storm

An insurance expert discusses when to claim for damages following the most recent rain showers and storms and what is likely covered or not. NBC 4’s Lolita Lopez reports on Feb. 6, 2024.

-

Tips for navigating home insurance in SoCal

Current homeowners tell the I-Team they are getting dropped from their home insurance coverage and are looking to the California FAIR Plan for basic hazard coverage. Gov. Gavin Newsom and the State Department of Insurance are implementing guidelines for insurance carriers to write more policies, but until then, experts recommend not letting your policy lapse and avoiding making small claims....

-

Getting Insured: Tips for finding home insurance in California

If 2024 is the year you can finally buy a new home, the next and maybe even greater challenge could very well be getting home insurance.

-

As open enrollment begins for Affordable Care Act health insurance marketplace, here's what you need to know for 2024

If you plan to have government health insurance coverage next year, you may be eligible for financial help. These tips can help you sort through your options.

-

Many states are expanding their Medicaid programs to provide dental care to their poorest residents

A growing number of states are offering dental care to low-income adults who once had to rely on charity or the emergency room to treat their tooth problems.

-

Wildfire-prone California makes deal to stop insurers from leaving the state

The effects of climate change have complicated home insurance for Californians, leading some companies to flee the state. But a new deal is now encouraging those same insurers to return.

-

California to write new rules for insurance pricing. What's changing for homeowners

California will let insurance companies consider climate change when setting their prices, the state’s chief regulator announced Thursday, a move aimed at preventing insurers from fleeing the state over fears of massive losses from wildfires and other natural disasters.

-

Global warming puts nearly 40 million properties at risk of rising insurance costs, new report says

Major insurers are withdrawing from California and Florida, while companies there and elsewhere are scaling back to guard against the escalating costs of global warming, but the problem is just beginning, according to a new report out on Wednesday.

-

Climate change and extreme weather could fuel another housing crisis

An estimated 39 million homes and businesses in the United States could soon face skyrocketing insurance premiums — if they can even find insurance coverage at all. That’s according to a new report from First Street Foundation, which warns that this “insurance bubble” could lead to a costly, widespread housing crisis coast-to-coast.